17-02-2022

I may sound corny. There is badness in the old and greatness in the new. There can also be sadness in the new and happiness in the old. ‘It may be a mistake to mix different wines, but old and new wisdom mix admirably.’

Let me tell you how I changed my life during the past 30 years. All were the results of crazy morbid ideas of communication technology scientists who intended to mentally torture old folks like me. When I was a kid in the 1960s, I loved the heavy telephone with a rotary dial, a curly cord and a handset. In the 1980s, my boss gave me a big box called ‘computer’. I was upset by its complicated functions. In the 90s, I was requested by my clients to carry a chocolate-like mental box bar called ‘mobile phone’ so that they could easily call me to get legal advice. Now, I am using a little monster known as ‘smart phone’ which is actually a mini-computer. I fondle it to google, check my messages, watch YouTube, use Step Counter, order food delivery and show off my face instagramatically. 2 months ago, friends asked me to operate my smart phone to exploit the greatest investment opportunity―NFT(non-fungible token非同質化代幣), a type of unique digital asset that you can own!

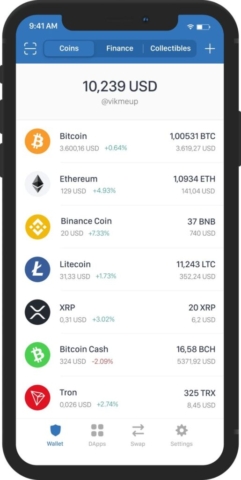

In Hong Kong, NFT is often not charged with profit tax. I was told: you can exchange your real cash with some virtual digital money like ‘ETH’, then put your money in an invisible online ‘crypto wallet’, then go to a foreign web called OpenSea or Rarible, then identify a virtual ‘NFT product’ like photograph, music or toy image, then let a stranger seller with a secret code take away your virtual money known ‘cryptocurrency(加密貨幣)’ of which there are many kinds; so that you finally can become the next owner of that piece of ‘non-edible’ known as NFT which is virtually existent in the exclusive private club known as a ‘blockchain(區塊鏈)’ where secret club members are chained together and carried out transparent online trading activities with each other. I was told again that the above arrangements are safe because all the players, though anonymous, could be monitored by a personalized code number. I was assured that the NFT platform is like a ‘wild party’ but nothing is scammy, except laundering money instead of ‘molly’, would occasionally flow into the gathering.

The development of communication technology over the past 30 years shows that human beings do not simply want to satisfy the needs for basic things like inter-personal communication, joy of enjoying online contents such as film, music and fascinating ‘mobile apps’. We, not surprisingly, now desire technology to satisfy our money greed too. This is why various innovative NFT platforms, regardless of their grand justifications, are currently utilized by hungry speculators to make money and run away.

Some criticized that Hong Kong is in a lawless situation so far as blockchain, cryptocurrency and NFT are concerned. This is not true. At the moment, we do not yet have a piece of target-specific legislation pinpointing the legality, or rather illegality, of the different acts and circumstances relating to the trilogy of the above technological innovations. We do however have existing statutes and common law, here and there, to catch the criminals. When you lose your ‘crypto’ money as a result by an online scam, you can go to the Police to complain about fraud. If the subject matter of NFT is a ‘security’, you can request Hong Kong Securities and Futures Commission (HKSFC) to investigate. In case of unscrupulous sales tactics manipulated by a platform, you can seek help from Hong Kong Customs. There are plenty other law enforcement examples but what the public earnestly would like the government to do is to re-define whether grey areas of NFT, a lot of them now being improper and savage, would be clearly against the law. A loud outcry is raised particularly by the unknowledgeable investing public that they should not bear all the risks without some government interventions.

Regarding the risk-taking judgment of an investor on the price and value of a piece of NFT, the following 6 factors must be taken into account by him before buying:

(1) reputation and popularity of a NFT creator;

(2) people want to buy the real NFT rarities. Supplying more than the market needs will curse a

NFT worth bad luck; and destroy its attraction;

(3) the intrinsic art or creative value of a NFT which should be the real reason why you want to own the work. The creative value of a product is its original charm reflecting its utility and importance. Purchased things should be non-obvious and imaginative with good creative skills;

(4) the popular NFT should be a great ‘content idea’ which keeps the social media curious, interested and much talking about;

(5) ‘trendability’―online trends have been getting shorter and shorter over the last few years because people are too quick to be out with the old and in with the new! New fantastic ideas bump into buyers every day and buyers can get easily distracted; and

(6) the appetite of speculators and market price-makers. They may not bother with any basis of fundamentals and analysis. They simply chase quicker and bigger gain, mindless of the consequences of risk undertaken.

Life is trying to explore new things to see if they will give us a new dimension of experience. Blockchain, cryptocurrency and NFT gave us a superb cast but we are still unable to figure out the plot of the film. We may not care. We are, meanwhile, more than happy to be amused richly by the numerous NFT-related novelties such as Samsung Micro LED TV for NFT display, NFT Art Gallery in shopping malls and future NFT museums. As a writer, I dream of publishing a NFT book and look for an author’s extra royalty claim over its E book resale at 10-15% per deal.

A great civilization is not achieved until it has destroyed and rebuilt. Putrefaction is not civilization. Good luck to NFTs!

This article can also be found at the following sites: